Sunday, December 24, 2006

The Economics of Christmas

Did you know that there are actually economists who study theories about Christmas Presents. Greg Mankiw summarizes the research here.

The idea is that Christmas gifts are signalling mechanisms, because in theory giving money should be the optimal gift (since the person can spend the money on whatever he or she wants). However, if a gift is a signal to show how much you care about a person, giving money seems like a big cop out.

You can test this theory out on your boyfriend or girlfriend, give them a gift certificate and see how they like it. Next Christmas--if he or she is still around---you can give them a gift.

Wednesday, December 20, 2006

Flat Panel Discounting

The price war has been a boon for consumers who, in some cases, were able to snap up the sets over the Thanksgiving weekend at below retailers' cost.

But growing competition and plummeting prices are taking a heavy toll on many retailers. The consumer-electronics market has turned into a free-for-all as the nation's largest electronics retailer, Best Buy Co., has fended off attacks by giant discounter Wal-Mart, which is looking to electronics to help recharge its growth. Flat-panel TVs this season also have cropped up for sale in such unaccustomed venues as home-improvement outlets, office-supply stores and discount chains.

This would be the classic example of a price war among Oligopolists

"Not only did the electronics chain withstand Wal-Mart's initial onslaught, it has continued to gain share. After Wal-Mart publicly crowed about its plan to offer a glitzy Panasonic plasma high-definition TV set for $1,294 the day after Thanksgiving, Best Buy fired back by offering the same TVs for $1,000 and calling it an "unadvertised special.""

Tuesday, December 19, 2006

Sidebar

PS-If this fixes itself, please ignore

Monday, December 18, 2006

Market Assumptions

Remember the 4 assumptions

1) Many buyers and sellers

2) Perfect information

3) Easy entry/exist

4) Homogenous product.

Monopolistic competition deviates from assumption 4.

Monopoly deviates from 1 and 3

and Oligopoly deviates from 1 and 3, though to a lesser extent (since there is more than one firm, and there is possible entry/exit). 4 is also likely violated, as in monopolistic competition (think the Video Console industry or Flat Panel TV's).

Study Hints for Final Exam

It is key to keep in mind that only under perfect competition is allocative efficiency (P=MC) and productive efficiency {min(ATC)} easily achieved.

In other markets, since some form of market imperfection exists (differentiated products, barriers to entry, small number of sellers, whatever) price does not necessarily equal marginal cost and ATC is not necessarily minimized.

Whether the government needs to step in and fix the problem, however, is another question, since the problem may be very small and may yield external benefits (in the form of product differentiation.)

Friday, December 15, 2006

Thursday, December 14, 2006

Ice Skating and the Invisible Hand

Wednesday, December 13, 2006

College Tuition and the "Baumol effect"

Quiz 10 - Comparative Advantage (Part I)

1) (5 points) Below is the maximum amount of CD's or PC's that can be built by the US and Japan.

Pre-Specialisation

UK

Personal Computers

2,000

CD Players

500

Japan

Personal Computers

4,000

CD Players

2,000

1) Who has the absolute advantage in PC's?

2) Who has the absolute advantage in CD players?

3) Who has the comparative advantage in PC's?

4) Who has the comparative advantage in CD Players?

5) Based on this, who should specialize in CD Players and who should specialize in PC's?

6) Name and explain 2 objections to free trade and the counter argument provided by Economists.

Monday, December 11, 2006

Game Theory Application

Friday, December 08, 2006

Various articles on Free Trade

Here is an article in the New Republic criticizing the Schumber/Roberts attack on free trade. The first few paragraphs give a good summary of what trade does to boost production. (Note: I would link to Schumer's original article but it is not available free online). But here is another blogger being less kind to Schumer on this issue.

If this is all confusing to you, let me try and explain comparative advantage using the following example. Let us assume there is a doctor and a secretary. The doctor has an absolute advantage in both surgeries and typing (he is the fastest typist in the world). In autarky (i.e. the position of no trade) he does a good number of surgeries but also a lot of time consuming typing. The secretary is unemployment or working at a lower wage job.

Comparative advantage says that it is advantagous for the Doctor to hire the Secretary to do his typing for him. This way he can concentrate on surgeries (boost his output on surgeries, where he makes a lot of money) and leave the typing to the secretary. It does not matter that the Secretary is a slower typist than he is. What matters is that by hiring the Secretary, he leaves more room to specialize in a field he can make a lot of money in and boost overall output. The Secretary is also better off because she is at a nice job with the Doctor whereas before she was either unemployment or working for much less money.

E-mail me if you are still having trouble.

Thursday, December 07, 2006

Video Game Price Wars

There are a number of reasons why this price war took place, but here is one of the more interesting reasons:

A flood of consoles on the market giving consumers too many choices. At the time of the U.S. crash, there was a plethora of consoles on the market: Atari 2600, Atari 5200, Bally Astrocade, Colecovision, Coleco Gemini, Emerson Arcadia 2001, Fairchild Channel F System II, Magnavox Odyssey2, Mattel Intellivision (and its just released update with slew of peripherals, Intellivision II), Sears Tele-Games systems (which included 2600 and Intellivision clones), Tandyvision, and Vectrex. Each one of these had their own library of games, and many had (in some cases large) 3rd party libraries. Likewise, many of these same companies announced yet another generation of consoles for 1984, such as the Odyssey3, and Atari 7800.[1]

Wednesday, December 06, 2006

Video game market redux

"Nintendo, though, has not just survived out of the spotlight; it has thrived. It has five billion dollars in the bank from years of solid profits, and this past year, though it spent heavily on the launch of the Wii, it made close to a billion dollars in profit and saw its stock price rise by sixty-five per cent. Sony's game division, by contrast, barely eked out a profit and Microsoft reportedly lost money. Who knew bringing up the rear could be so lucrative?"

There seem to be a few explanations for this

1) Because Nintendo is not trying to dominate the market, they are making money on its consoles rather than losing $240 dollars a sale. This makes profits, at least in the short term, easier to come by

2) Nintendo makes more of its games in house rather than through 3rd parties. Therefore, the return on its investment is higher

3) You do not need to dominate the market in order to be successful. Although the Video Game industry (at least console wise) is an oligopoly, Nintendo can still thrive despite not being thdominantnt factor because it caters to a niche market that Playstation and X-Box are not capturing. And you don't need to develop a computer suited for high tech weaponry in order to satisfy them.

Of course, this doesn't mean that Sony will not dominate in the long run. The playstation 2 accounted for over half of Sony's profits just recently. All that is being inferred here is that Nintendo can still compete despite not having the dominant system.

Tuesday, December 05, 2006

Taco Bell

The fast food industry has differentiated products. Taco Bell fills a nitch for Latam fast food. But will it serve the Latam ecoli fast food market?

Monday, December 04, 2006

Quiz 9 due Tuesday Dec 5th

Quiz 9 – Intro to Micro Economics.

Professor Matthew Festa

Due in Class Tuesday Dec 05

1) State the 4 assumptions of perfect competition and then state the assumption(s) that monopolistic competition breaks. State the assumption(s) that an oligopoly breaks (2 points)

2) What is allocative efficiency? What is productive efficiency? Why does monopolistic competition fail to meet both of these? (2 points)

3) Explain why on the above graph, the demand curve slopes down for a monopolistically competitive firm. (2 points).

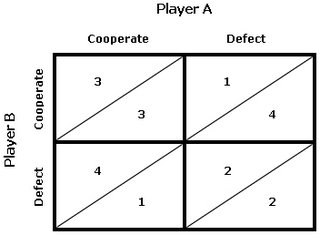

4) On the below table, explain which box would be the best case scenario for These two companies. What is Nash equilibrium? Explain why that is the point the market will tend towards. Think of Company A as Coca Cola and Company B as Pepsi. The numbers are profits for both companies in billions (so 3 = $3bn). (3 points).

Sunday, December 03, 2006

Quiz 9

Friday, December 01, 2006

How good is Jim Cramer's investment advise?

There is actually theoretical backing for this and its called the efficient market hypothesis. The idea is related to perfect competition. Since there are so many buyers and sellers in the market that possess all necessary information about an investment (stocks, bonds etc) a professional money manager should not be able to outperform a normal buy and hold pattern of a well diversified portfolio. The evidence for this is actually quite strong.

The real kicker is what exactly do we mean by all information? Are we talking about all past price moves (the weak form), all publically available knowledge, including my predictions (the semi-strong) or all public and private knowledge (the strong form).

I think most economists would agree that most markets are either weak to semi-strong efficient markets. However, it looks like the market to predict the currenct Pope was strong form

Free Trade

The main points of his article can be summarized by this story:

"The surgeon talks about needing to give her house a new coat of paint. Her tennis partner suggests that compared with a typical house painter she probably could do this job better herself. "That's true," the surgeon replies. "I have steady hands, and I work more carefully and efficiently than most painters. But I figured that even though it will take the painters 50 hours to do the house and I could do it in 40, it's still a better use of my time to see patients. I can pay the painters with the money I get from seeing patients for two hours, so in a way I can paint my house in just two hours by sticking to medicine."

This one:

Finally, the tennis partner says. "My brother-in-law had a kidney stone. I was going to recommend that he come to you, but his doctor said that there is a new pill that dissolves some stones. So he doesn't need surgery."

And finally, this comment:

"The last anecdote illustrates one of the most subtle benefits from trade. Competition and trade lead to innovation, in this case the development of a drug that reduces the cost and risk of removing kidney stones.

Competition and innovation are not necessarily a benefit for the surgeon. The demand for her services falls to the extent that medication can be used in place of surgery"

Me: Think about this another way. Free trade and technological innovation have destroyed numerous jobs in agriculture over the past century (before the 20th century America had many more jobs in agriculture. I believe the figure is now down to 2%.) But the gains from trade, an exponential increase in food production, vastly outweighed the loss of jobs in that industry. Further, with jobs opening up in industries that American had a comparative advantage in, people migrated towards those new jobs and normal economic development created other jobs. At the end of the day the economy has many more jobs now (at higher pay!) than they did 100 years ago.